Introduction to Crypto

Crypto has revolutionized the way people perceive money, investments, and digital transactions. As a form of digital or virtual currency that uses cryptography for security, crypto eliminates the need for traditional banks and enables decentralized financial systems. With the growing popularity of Bitcoin, Ethereum, and other cryptocurrencies, understanding crypto has become essential for investors, businesses, and technology enthusiasts. The rise of crypto highlights the increasing importance of digital assets in the global economy and the transformative power of blockchain technology.

How Crypto Works

At its core, crypto operates on blockchain technology, a decentralized ledger that records transactions across multiple computers. This ensures transparency, security, and immutability, which are key advantages over traditional financial systems. Each crypto transaction is verified by network nodes through complex algorithms, making it nearly impossible to manipulate. Crypto wallets, exchanges, and mining are essential components of the ecosystem, allowing users to store, trade, and create digital currencies securely. Understanding how crypto works is fundamental for anyone looking to invest or engage in the crypto market.

Popular Cryptocurrencies

The crypto market is diverse, with thousands of digital currencies available today. Bitcoin, the first and most widely recognized crypto, remains a benchmark for the entire industry. Ethereum introduced smart contracts, enabling decentralized applications and advanced blockchain solutions. Other notable cryptos like Binance Coin, Cardano, and Solana offer unique features and opportunities for investors and developers. Staying informed about popular cryptocurrencies and their market dynamics is critical for making strategic investment decisions and leveraging the full potential of crypto.

Crypto Investment Strategies

Investing in crypto requires careful planning and risk management. Long-term holding, or “HODLing,” is a common strategy for capitalizing on crypto’s potential appreciation over time. Day trading and swing trading involve short-term strategies based on market trends and technical analysis. Diversification across multiple crypto assets can reduce risk while maximizing growth potential. Investors must also stay updated on regulatory developments, market sentiment, and technological innovations, as these factors significantly influence crypto prices and adoption.

Crypto Market Trends

Monitoring crypto trends is crucial for both investors and tech enthusiasts. Recent trends include the growth of decentralized finance (Defi), the rise of non-fungible tokens (NFTS), and the increasing adoption of crypto payments by businesses worldwide. Additionally, institutional investments in crypto are expanding, further legitimizing digital currencies as mainstream financial assets. Staying ahead of crypto trends allows individuals and companies to capitalize on emerging opportunities and adapt to the evolving market landscape.

Benefits of Crypto

Crypto offers numerous advantages over traditional financial systems. Transactions are faster, often cheaper, and can be executed globally without intermediaries. Crypto provides greater financial inclusion, giving access to banking services for people in underserved regions. Additionally, blockchain technology ensures transparency, security, and traceability of all crypto transactions. These benefits are driving widespread adoption and encouraging governments, corporations, and individuals to explore the potential of crypto.

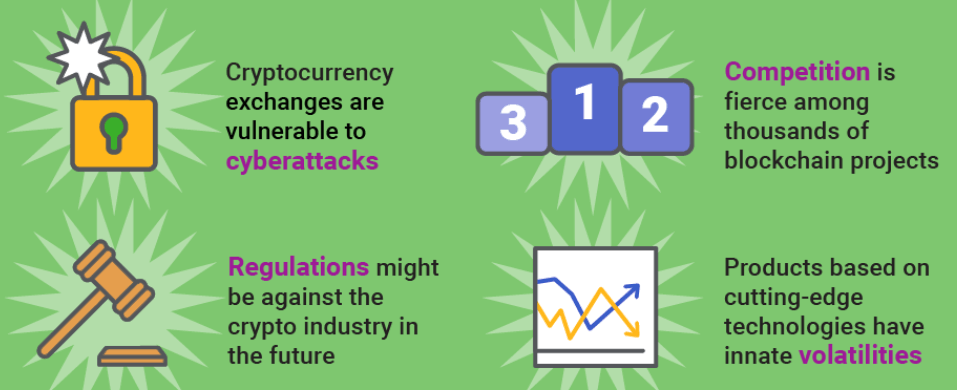

Challenges in Crypto Adoption

Despite its benefits, crypto adoption faces challenges. Regulatory uncertainty, market volatility, and cybersecurity risks are major concerns for investors and users alike. The environmental impact of crypto mining, particularly for energy-intensive cryptocurrencies like Bitcoin, is also a topic of ongoing debate. Addressing these challenges through secure practices, regulatory compliance, and sustainable technologies is essential for the long-term growth of crypto. Awareness of these issues ensures users can navigate the crypto landscape responsibly and effectively.

The Future of Crypto

The future of crypto looks promising, with innovations such as decentralized finance, blockchain-based applications, and central bank digital currencies (CBDCs) reshaping the financial sector. As technology advances, crypto is expected to play a more significant role in global finance, commerce, and even everyday transactions. Increased adoption by businesses, integration with emerging technologies, and supportive regulations could drive the next phase of growth for crypto. Staying informed and adaptable is key to thriving in the rapidly evolving crypto ecosystem.

Conclusion: Embracing Crypto

Crypto is no longer just a niche interest; it is an integral part of the future of finance and technology. Understanding crypto, keeping up with market trends, and adopting safe investment practices are crucial steps for anyone looking to participate in this digital revolution. From investors to tech innovators, embracing crypto offers opportunities for financial growth, technological advancement, and global connectivity. By staying informed and proactive, individuals and organizations can leverage the full potential of crypto and contribute to its transformative impact on the world.